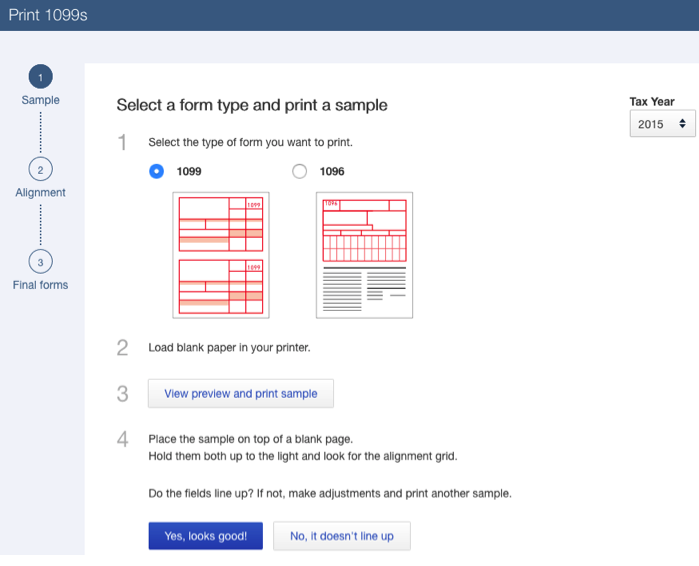

Since it has been a month and your QuickBooks Dekstop has still generated 2 copies per page, I recommend updating your QuickBooks Desktop to the latest release to keep your software up-to-date so you always have the latest features and fixes. That said, QuickBooks is already updated to print 1099's three to a page instead of two to a page. However, with the new tax year 2021, form 1099-NEC was resized, and the height of the form was reduced to accommodate three forms on a page. Intuit offers 1099 Forms (two per sheet) with a size of 8 1/2" x 11" and compatible double-window envelopes of 5 5/8" x 8 3/4". When preparing 1099 forms, if you choose not to e-file with Intuit, you'll want to print out copies to mail and complete your filing with the IRS, plus print and send a copy to each of your contractors. QuickBooks has a time-saving feature to help you prepare your 1099s from the info you already have in your accounts. Then, ensure you'll be able to use and accommodate three forms on a page. I'll be sharing details on how printing a 1099 form works with the new updates. Thank you for visiting the QuickBooks Community. If you have any other questions about viewing the 940 forms, let me know by adding a comment below. Lastly, use this year-end checklist to prepare your tax forms in QBDT Payroll. Fix overdue or red scheduled liabilities in QuickBooks Desktop.Check e-file or e-pay status in QuickBooks Desktop Payroll Enhanced.

#OFFICE MAX QUICKBOOKS 1099 KIT HOW TO#

0 kommentar(er)

0 kommentar(er)